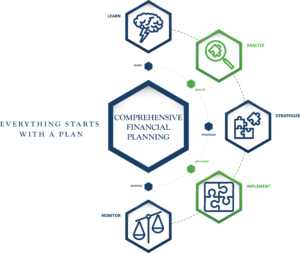

Everything Starts With a Plan

Before it is built, every home starts with a blueprint. A plan. Without it, you have no certainty as to the stability or longevity of your home. The same can be said for your investments. The path towards your financial future requires a clear vision, a detailed plan, and a dynamic team. Taking every factor of this important process into account, we construct powerful blueprints for building and retaining wealth. Our innovative approach includes estate planning, investment strategies and business succession planning.

By having a well thought-out plan, you are better positioned to attain your goals more efficiently and effectively. At CWA, we’ve built a team of professionals exclusively positioned to assist us in finding solutions to solve even the most complex financial situations. Our team includes several Certified Financial Planners™, while others may call themselves financial planners, only those who demonstrate the requisite experience, education and ethical standards are awarded the CFP® mark.

Learn

We want to learn and understand what your concerns, goals and objectives are for you, your family or business.

Analyze

We’ll analyze your current financial situation by conducting an in-depth evaluation of your portfolio and how it aligns with your needs, goals and risk tolerance.

Strategize

We will then create a customized plan designed specifically to address all of your goals and concerns efficiently and effectively.

Implement

We will then implement your strategy into action.

Monitor

We will continuously monitor your strategy to ensure it is operating as originally designed.

Get Your Customized Plan Today.

Let’s Get Started!