Grandparents & 529s

December 6, 2023 | Patrick Barry, AIF®

I’ve received a few questions lately regarding potential tax benefits of a Grandparent owned 529 account. Due to the interest on these types of accounts, I figured it best to send out a piece on 529s.

What is a 529 plan?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. 529 plans, legally known as “qualified tuition plans,” are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code (original name, I know). Contributions to 529 plans are considered gifts.

Some states, like Pennsylvania, allow 529 contributions to be deducted from their state tax returns. These rules vary, so please consult a tax advisor or accountant regarding your individual situation.

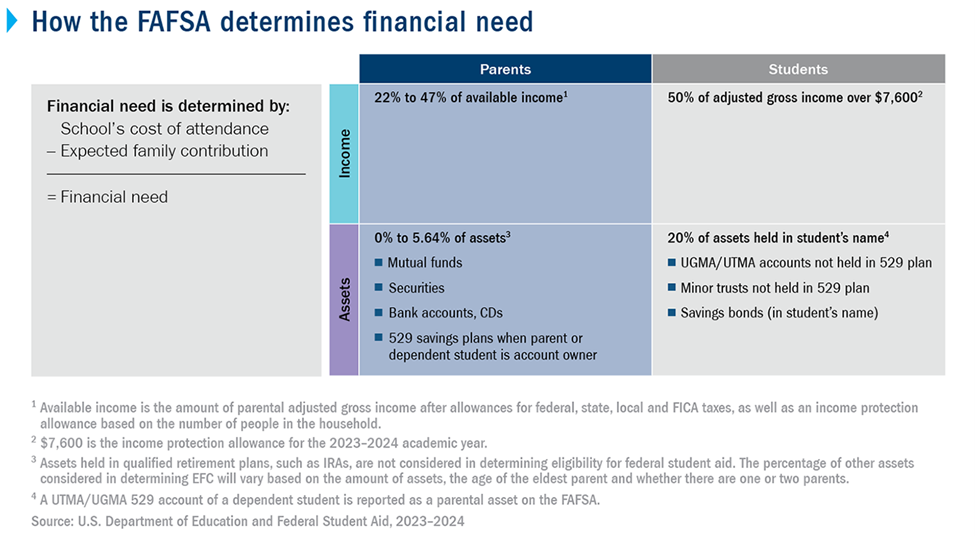

When a student plans to attend a college or university, the family typically completes the Free Application for Federal Student Aid (FAFSA). The process determines how much financial need a student may receive based on the school’s cost of attendance and the “expected family contribution”.

How does the FAFSA determine the expected family contribution (EFC)?

In the past, and currently, a 529 plan owned by a Grandparent is not counted as an asset to either the Parent or the Student, so it is not considered in the EFC calculation resulting in a potentially higher amount of financial aid. However, the parents are required to disclose any cash support the student receives as income, which includes 529 distributions from the Grandparent owned 529 plan.

The NEW FAFSA

A new FAFSA questionnaire will be in effect for the 2024-2025 academic year, no longer requiring students to manually disclose cash support on the FAFSA. As a result of the Consolidated Appropriations Act of 2021, all student income will be taken from tax return data using the IRS Data Retrieval Tool (DRT). So grandparents can finally contribute significantly to the cost of the grandchildren’s education without impacting any needs-based financial aid eligibility.

Bottom Line

Grandparent owned 529 plans receive the same potential tax benefits as a Parent owned 529 plan but the grandparent owned 529 does not impact the student’s needs-based financial aid eligibility starting in 2024.

If you have any specific questions regarding this topic, please do not hesitate to contact us to review your specific situation.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses, summary prospectuses and 529 Product Program Description, which can be obtained from a financial professional and should be read carefully before investing. Depending on your state of residence, there may be an in-state plan that offers tax and other benefits which may include financial aid, scholarship funds, and protection from creditors.. Before investing in any state’s 529 plan, investors should consult a tax advisor. If withdrawals from 529 plans are used for purposes other than qualified education, the earnings will be subject to a 10% federal tax penalty in addition to federal and, if applicable, state income tax.